a pox on both their houses.

When David Cameron went to Brussels to kick the Continent around,

it was just more kabuki theatre.

Every time those 'heads' meet, I gotta find out the true meaning

of their actions. So, watch the video below.

You thought it was only Cameron playing the baddie?

Well, the other option, the 'just piss off, Dave' option,

was to allow the EU's unelected bureaucrats to run your

ministry of finance, if they see fit. It is again creeping

anti-democracy, in the guise of saving a Euro currency

whose goose is cooked.

How do you like them canards? Conneries? Putain!

Luckily, some of the former Eastern Bloc countries, like

the Czech Rep and Poland recognise imperialism when they

see it.

checkitout: Carl Denninger

European leaders must cease their “theatrics” and avoid curbing economic growth in forging a closer fiscal union to overcome the region’s debt crisis, Polish Deputy Prime Minister Waldemar Pawlak said.

http://www.bloomberg.com/news/2011-12-13/eu-must-stop-theatrics-to-fortify-bloc-polish-minister-says.html

Thursday 15 December 2011

Thatcher unleashed a bunch of Enrons

fleecing the public is good for business.

It was stupid to have the government monopolise heating and electricity.

It's so inefficient.

It's much better to take the riches that Britain provides to all,

and give them away to something called an 'oil company'. Since they

can get the oil, it's theirs, not everybody's.

It's best then to help that oil company re-cuperate its expenses

by gouging the public.

There are now 5 or so energy companies in the UK. They are a cartel,

and fix the prices, which is uncompetitive.

They pass on increases in oil costs , but not the decreases.

Apparently 2000 people die each winter because they don't have enough

money to heat their homes.

I'm sure those companies are trading on CDOs and CDSs as well, with

fancy accounting and the tax haven tricks. Just like Enron, and

everybody else in the oligarchy.

more later

UPDATE:

Ed Milliband has heard the call.

checkitout:

Ed Miliband calls for an end to Britain's 'rip-off consumer culture'

Labour leader urges David Cameron to take a tougher approach to 'predatory' companies that exploited customers

Ben Quinn

* The Guardian, Wednesday 18 January 2012

....

• Energy companies: the big energy firms should be broken up and transparent pricing introduced to enable proper competition.

2 DAILY MAIL

Thousands dying because they can't afford heating bills... and green taxes are adding to the burden

* Cold houses also result in tens of thousands of cases of respiratory problems and sickness

* Profits of energy firms have risen to £125-a-year per customer

* Consumer group says Government is a long way from getting to grips with crisis that puts a strain on NHS during winter

By Sean Poulter, Consumer Affairs Editor

Last updated at 3:22 PM on 20th October 2011

Rising profits: The dark yellow net margin line on this graph spikes from August this year upwards, with Ofgem predicting that suppliers' margins will level out more next year if fuel bills and prices remain the same

More than 2,700 people are dying each year in England and Wales because they cannot afford to keep their homes warm, according to an official study.

The spiralling cost of gas and electricity combined with the impact of green taxes is putting health and lives at risk, researchers found.

The study concluded that green taxes on household power bills are ‘regressive’ and have a disproportionate impact on poorer households.

The warning of the dangers to health comes from social policy expert Professor John Hills, of the London School of Economics, in a study commissioned by Energy and Climate Change Secretary Chris Huhne.

On the policy of adding green taxes to bills, Professor Hills said: ‘Those energy and climate policies that lead to higher prices will largely have a regressive impact.’

He highlighted a government study which found that the poorest one-fifth of households would see their income fall 0.8 per cent as a direct result of green taxes and the move to renewable energy, while the richest fifth would break even.

Professor Hills said: ‘Whether this regressive outcome, which would tend to increase fuel poverty, occurs depends on both more recent developments, such as the Warm Home Discount, and decisions yet to be taken.’

The Warm Home Discount of £120 off electricity bills is currently being offered to around 600,000 of the poorest households.

Green taxes designed to meet a £200billion bill to switch to wind, wave, solar and nuclear power currently add around £100 to annual bills.

However, this figure is set to rise sharply in the next few years and will hit the poor, particularly pensioners on fixed incomes, harder than most.

It was stupid to have the government monopolise heating and electricity.

It's so inefficient.

It's much better to take the riches that Britain provides to all,

and give them away to something called an 'oil company'. Since they

can get the oil, it's theirs, not everybody's.

It's best then to help that oil company re-cuperate its expenses

by gouging the public.

There are now 5 or so energy companies in the UK. They are a cartel,

and fix the prices, which is uncompetitive.

They pass on increases in oil costs , but not the decreases.

Apparently 2000 people die each winter because they don't have enough

money to heat their homes.

I'm sure those companies are trading on CDOs and CDSs as well, with

fancy accounting and the tax haven tricks. Just like Enron, and

everybody else in the oligarchy.

more later

UPDATE:

Ed Milliband has heard the call.

checkitout:

Ed Miliband calls for an end to Britain's 'rip-off consumer culture'

Labour leader urges David Cameron to take a tougher approach to 'predatory' companies that exploited customers

Ben Quinn

* The Guardian, Wednesday 18 January 2012

....

• Energy companies: the big energy firms should be broken up and transparent pricing introduced to enable proper competition.

2 DAILY MAIL

Thousands dying because they can't afford heating bills... and green taxes are adding to the burden

* Cold houses also result in tens of thousands of cases of respiratory problems and sickness

* Profits of energy firms have risen to £125-a-year per customer

* Consumer group says Government is a long way from getting to grips with crisis that puts a strain on NHS during winter

By Sean Poulter, Consumer Affairs Editor

Last updated at 3:22 PM on 20th October 2011

Rising profits: The dark yellow net margin line on this graph spikes from August this year upwards, with Ofgem predicting that suppliers' margins will level out more next year if fuel bills and prices remain the same

More than 2,700 people are dying each year in England and Wales because they cannot afford to keep their homes warm, according to an official study.

The spiralling cost of gas and electricity combined with the impact of green taxes is putting health and lives at risk, researchers found.

The study concluded that green taxes on household power bills are ‘regressive’ and have a disproportionate impact on poorer households.

The warning of the dangers to health comes from social policy expert Professor John Hills, of the London School of Economics, in a study commissioned by Energy and Climate Change Secretary Chris Huhne.

On the policy of adding green taxes to bills, Professor Hills said: ‘Those energy and climate policies that lead to higher prices will largely have a regressive impact.’

He highlighted a government study which found that the poorest one-fifth of households would see their income fall 0.8 per cent as a direct result of green taxes and the move to renewable energy, while the richest fifth would break even.

Professor Hills said: ‘Whether this regressive outcome, which would tend to increase fuel poverty, occurs depends on both more recent developments, such as the Warm Home Discount, and decisions yet to be taken.’

The Warm Home Discount of £120 off electricity bills is currently being offered to around 600,000 of the poorest households.

Green taxes designed to meet a £200billion bill to switch to wind, wave, solar and nuclear power currently add around £100 to annual bills.

However, this figure is set to rise sharply in the next few years and will hit the poor, particularly pensioners on fixed incomes, harder than most.

Sunday 11 December 2011

When is telling the truth damaging to your health?

When you're running for the Republican nomination for president.

Ron Paul is taking a lot of risks by calling a spade a spade.

I fear for his life, because he’s on track to win the GOP, and

that will simply not be allowed to happen.

Paul has said, repeatedly:

-US democracy is not fair

-Patriot Act was opportunistic grab of civil rights

-US army's actions around the world cause terrorism

-US wars should end

Watch out for grassy knolls, my friend.

[watch out for men dressed as kids' characters from Britain, especially the 'gay' one]

checkitout: zerohedge

Ron Paul: “The PATRIOT Act Was Written Many, Many Years Before 9/11 [And The Attacks Simply Provided] An Opportunity

Submitted by George Washington on 12/09/2011 18:16 -0500

Politico notes:

Ron Paul isn’t backing down from his position that the U.S. has provoked terrorists through foreign military occupation and that officials tried to capitalize on Sept. 11 attacks.

“Think of what happened after 9/11, the minute before there was any assessment, there was glee in the administration because now we can invade Iraq, and so the war drums beat,” Paul said Thursday night before a packed room of more than 1,000 students and supporters. “That’s exactly what they’re doing now with Iran.”

His libertarian ideals have struck a cord with many, but conservatives remain deeply wary of Paul’s foreign policy positions, including his assertion that the U.S. provoked the Sept. 11 attacks by maintaining military bases in foreign countries. Paul’s position as the lone dove in the GOP race has made him a foil for some of his hawkish Republican opponents.

“Extremists have taken over, and they’re the ones who run the foreign policy and have convinced us to go along with all these wars,” Paul said Wednesday night.

Paul said that claims Iran could be developing a nuclear weapon are just part of an effort to scare Americans into going to war again.

Paul said of the possibility that Iran has a nuclear weapon is “not true at all.” “It doesn’t mean they might not want a nuclear weapon.”

No other country, Paul said, is capable of attacking the United States.

“How many foreign countries can threaten us right now?” Paul asked sarcastically. “How many are likely to invade us or drop a bomb on us? I can’t imagine.”

“The PATRIOT Act was written many, many years before 9/11,” Paul said. The attacks simply provided “an opportunity for some people to do what they wanted to do,” he said.

“I wish we could guarantee a democratic and honest election in this country as well,” Paul said. “The democratic process in this country has a long way to go.” Mr. Paul is right.

Ron Paul is taking a lot of risks by calling a spade a spade.

I fear for his life, because he’s on track to win the GOP, and

that will simply not be allowed to happen.

Paul has said, repeatedly:

-US democracy is not fair

-Patriot Act was opportunistic grab of civil rights

-US army's actions around the world cause terrorism

-US wars should end

Watch out for grassy knolls, my friend.

[watch out for men dressed as kids' characters from Britain, especially the 'gay' one]

checkitout: zerohedge

Ron Paul: “The PATRIOT Act Was Written Many, Many Years Before 9/11 [And The Attacks Simply Provided] An Opportunity

Submitted by George Washington on 12/09/2011 18:16 -0500

Politico notes:

Ron Paul isn’t backing down from his position that the U.S. has provoked terrorists through foreign military occupation and that officials tried to capitalize on Sept. 11 attacks.

“Think of what happened after 9/11, the minute before there was any assessment, there was glee in the administration because now we can invade Iraq, and so the war drums beat,” Paul said Thursday night before a packed room of more than 1,000 students and supporters. “That’s exactly what they’re doing now with Iran.”

His libertarian ideals have struck a cord with many, but conservatives remain deeply wary of Paul’s foreign policy positions, including his assertion that the U.S. provoked the Sept. 11 attacks by maintaining military bases in foreign countries. Paul’s position as the lone dove in the GOP race has made him a foil for some of his hawkish Republican opponents.

“Extremists have taken over, and they’re the ones who run the foreign policy and have convinced us to go along with all these wars,” Paul said Wednesday night.

Paul said that claims Iran could be developing a nuclear weapon are just part of an effort to scare Americans into going to war again.

Paul said of the possibility that Iran has a nuclear weapon is “not true at all.” “It doesn’t mean they might not want a nuclear weapon.”

No other country, Paul said, is capable of attacking the United States.

“How many foreign countries can threaten us right now?” Paul asked sarcastically. “How many are likely to invade us or drop a bomb on us? I can’t imagine.”

“The PATRIOT Act was written many, many years before 9/11,” Paul said. The attacks simply provided “an opportunity for some people to do what they wanted to do,” he said.

“I wish we could guarantee a democratic and honest election in this country as well,” Paul said. “The democratic process in this country has a long way to go.” Mr. Paul is right.

The Daily Mainstream Media Faberian

[I'll buy that for a dollar- somebody wants a newspaper. Robocop movie, addictedtoquack]

[I'll buy that for a dollar- somebody wants a newspaper. Robocop movie, addictedtoquack]Read all about it: RECENT NEWSPAPER TITLES

All harmless political activity is illegal.

All malfeasance has the government stamp of approval.

Move along. Nothing to see here.

[Brooklyn Bridge Gauntlet]

[Brooklyn Bridge Gauntlet] [Greek police break up beach volleyball]

[Greek police break up beach volleyball] [Rome]

[Rome] [washington post]

[washington post]

[don't watch the tv news. it stinks.-william banzai]

[don't watch the tv news. it stinks.-william banzai]

Grimace and Gromit

[Reuters]

[Reuters] [Orange]

[Orange] [Guardian]

[Guardian]The mark of the fool, Cameron, is still there. Look at his grimaces.

Turn up the heat a little , and it's a gern-fest. Clegg , too.

He feels the pain of not being part of the continent he

loves. It’s a theoretical love of European history, Roman and so on.

He did the right thing for the wrong reasons. He was given orders by

the banks, who are in turn

ruining the British and EU economies, if not the whole world.

David Cameron did the only other thing he could have and

followed his banks' desires. Another reason for this is

that GB is fiscally vulnerable and can’t do a 3% limit on its

yearly defecit, because of the banks and the debt they’ve

shifted to their loosey-arsed sovereign.

I support most of what Ash says (below), but I also think

that, though fiscal control is good I’m more worried about

the accumulated debt. Also, I don’t go for the federal EU

because look what it did to Greece’s and Italy’s democracies,

just to save a few northern banks. That’s not the right

kind of union. In fact there’s too much money being

thrown at unelected politicians in the Commission of Barosso,

and van Rumpoy.

They’re profligate and beyond reproach. I think they should

have stuck to a trade union and a few laws to protect the

environment and labour.

Also all this recent bullshit will not turn the tide with the

current crisis. It’s like, there’s a fire today and instead of

fighting it, they’re ordering new fire trucks for 2 years from

now.

If you want good reasons for not signing the treaty,

look at the other Chuks'

(Czech Rep, Hungary, UK, Sweden) reasons,

particularly the Czech Chuks.

They just threw off the Russians, and were not wearing

rose-coloured glasses and were not enamored of the EU,

but merely a practical nation joining a customs union,

or so they thought.

checkitout: Ash in the Guardian

http://www.guardian.co.uk/business/2011/dec/09/cameron-european-gang-of-four-chuks

“The Czechs are profoundly Eurosceptic and an observer said the domestic problems of Petr Necas's government were so acute that "it is unrealistic now to be part of some agreements of this kind". He added: "There are no real euro fans in the Czech Republic."Jan Zahradil, a fellow member of the Civic Democratic party and chairman of the European Conservatives and Reformists group, explicitly praised David Cameron and Necas for "defending the interests of their citizens" and refusing to surrender fiscal sovereignty."The leaders of the eurozone unfortunately missed the opportunity to transform the EU into a flexible, open structure, insisting instead on a narrow-minded and obsolete federalist concept, which leads the EU only in one direction: that of ever-closer integration," he added – welcoming a two-speed, two-tier Europe and insisting on protection for the single market.”

Thursday 8 December 2011

Merkel plays Punch and Judy with Cameron

The Euro referendum try by back benchers was an attempt to sweep

away anti-EU sentiment for the next few years, because it takes a

few years for the lazy Conservative back benchers to get up the

guts/blood pressure to make a rather opinion felt.

One of the lazy, fat victims is Boris Johnson the ‘second’,

some say first Conservative politician in the UK. He thinks

that Cameron will stand up to Merkozy, when he has studied

the history of the Continent since antiquity and sees

himself as part of that history. He will ask for nothing

and be thrown a bone by Merkozy that he can take home

for the UK to nibble on.

away anti-EU sentiment for the next few years, because it takes a

few years for the lazy Conservative back benchers to get up the

guts/blood pressure to make a rather opinion felt.

One of the lazy, fat victims is Boris Johnson the ‘second’,

some say first Conservative politician in the UK. He thinks

that Cameron will stand up to Merkozy, when he has studied

the history of the Continent since antiquity and sees

himself as part of that history. He will ask for nothing

and be thrown a bone by Merkozy that he can take home

for the UK to nibble on.

Hitler and Churchill redux

Used to be a time when I would say that we should have let

the Germans run all the trains and car factories in Europe.

But , Hitler wouldn't have been happy with only that.

But I'm beginning to wonder why my ancestors fought these

guys off. We went into the EU, with the intention of

stopping wars, the best intentions. And we've ended up with

a common currency that is being run by bankers, and those

bankers are 'making' the unelected leaders of Europe

call a halt to democracy: van Rumpy, Barosso, Merkel.

Will this lead to war?

Once met a former stagiaire from Belgium who told me

that the EU = whatever Germany, the UK and France want

is what happens. I found it hard to defend, until this week.

And now that the whole thing is coming crashing down,

those three are deciding and nobody seems to be complaining.

It's a troika, dammit!

Now we can see it clearly. Merkel can cancel Sarkozy, but she

can't stop the UK. Luckily for her, Cameron is a twit. Anyway,

the way things are going, Hitler's dream is coming true.

the Germans run all the trains and car factories in Europe.

But , Hitler wouldn't have been happy with only that.

But I'm beginning to wonder why my ancestors fought these

guys off. We went into the EU, with the intention of

stopping wars, the best intentions. And we've ended up with

a common currency that is being run by bankers, and those

bankers are 'making' the unelected leaders of Europe

call a halt to democracy: van Rumpy, Barosso, Merkel.

Will this lead to war?

Once met a former stagiaire from Belgium who told me

that the EU = whatever Germany, the UK and France want

is what happens. I found it hard to defend, until this week.

And now that the whole thing is coming crashing down,

those three are deciding and nobody seems to be complaining.

It's a troika, dammit!

Now we can see it clearly. Merkel can cancel Sarkozy, but she

can't stop the UK. Luckily for her, Cameron is a twit. Anyway,

the way things are going, Hitler's dream is coming true.

Monday 5 December 2011

when is an insider also a lobbyist?

When he's an American congressman.

That would be added to the inside info they get from Wall Street,

that are, while not illegal, definetly immoral, and function as

legal bribes.

It's one thing to be against public health care. They are Americans,

after all. It's another thing to sell yourself as a lobbyist

for big Med and get them access to your colleagues, especially

those whose bank accounts need a little massaging.

There are only a few Congressmen who are relatively clean,

though don't say I made them angels:

Bernie Sanders, Vermont

Denis Kucinich, Ohio

Anthony Weiner, former. He was got to. Turpitudes.

Alan Grayson, former. He was got to. GOP money bags and lies

one congresswoman from Cleveland whose name I can't find.

Any others?

Most of the rest are Flushmores.

If they weren't already millionnaires, they became so

by becoming politicians

Mark Twain says it best:

Fleas can be taught nearly anything that a Congressman can.

- What Is Man?

Suppose you were an idiot. And suppose you were a member of Congress. But I repeat myself.

- Mark Twain, a Biography

Congressman is the trivialist distinction for a full grown man.

- Notebook #14, Nov. 1877 - July 1878

Don't say I didn't warn you

[this is the Groupon stock price, which has fallen after a fraudulent, insider-job IPO]

[this is the Groupon stock price, which has fallen after a fraudulent, insider-job IPO] [that's my investment portfolio, what's left of it. Where's that banker?]

[that's my investment portfolio, what's left of it. Where's that banker?]It looks like the US stock market is built on nothing

but fraud and deceit. From the CME not backing up the

MF Global customers who were stolen from, to the

lack of trials for the '08 crash, this bird is cooked.

Here's a lady who puts it succinctly:

on Financial Sense Website

Ann Barnhardt: Well that is the point of this. We are now living in a lawless, Marxist, Communist, usurped, what used to be a representative republic but is no more. This is no longer a nation of laws....

It is Chris Christy who beat Jon Corzine to become the governor of New Jersey. So yes, this Republican, Chris Christy, was elected in New Jersey—uber liberal, blue state New Jersey—because Corzine financially destroyed this state. And again, this guy Corzine is former head of Goldman. He is not stupid. You have to stop thinking that these people are just misguided or that there is some sort of a difference of opinion on economic theory. These people are nefariously trying to destroy everything in this country. It's called the Cloward-Piven strategy. Go in and destroy and collapse the entire economy, everything and then rebuild a new Marxist, Socialist, fascist state...

Total systemic collapse. Get out! I don’t know how I can be anymore plain about this. I say this over and over and over again and then I get scads of emails saying, well I can’t get out of my 401k. Yes, you can. Yes, you can. Take the penalty and get the hell out of there. What would you rather do? Would you rather pay the 10% penalty or would you rather have it all go up in smoke?

Monday 28 November 2011

Derivatives: a magic way to hide money

[just ask Monti, a magic GS man]

[just ask Monti, a magic GS man]where’s your money?

Here’s the money.

Where’s your money?

Oops. All gone. Want to play again?

Derivatives can make money disappear, if you want to cry poverty.

and you can make it re-appear if you want to save some money.

That's what Germany did when it needed 55 billion euros.

This was my idea. My blog, about a year ago, had a story

about a derivatives amnesty, because all the players

owe one another the same pot of money. I said they

should all just back out and settle any petty differences

with a cheque or two.

Well, the game is much more cunning than that. Derivatives,

CDOs and CDSs exist to make dark pools and to manipulate the

markets, especially since those dark players can not be

revealed. It's all secret and cloak and dagger.

When they want a crisis, they pull a few strings and BOOM,

we get a crisis.

As Max Keiser says, they always could have done this but now they’re smelling social unrest and just letting the leash out oh so little. As little as possible. Not so that anybody gets encouraged enough to not want to kill all politicians.

CHSmith

Germany "Raises" €55.5 Billion, or 1% Of Its Debt/GDP Ratio, Thanks To Derivative "Accounting Error"Submitted by Tyler Durden on 10/28/2011 21:11 -0500

As usual, the most surreal news of the day, perhaps week, is saved for Friday night, when we learn that Germany has magically raised over a quarter of its total EFSF obligation of €211 billion by way of what is essentially magic. The Telegraph reports that "Germany is €55bn richer than it previously thought because of an accounting error at state-owned bank Hypo Real Estate Holding. The mistake at "bad bank" FMS Wertmanagement, happened because collateral for....

Hallowe'en comes home for foreclosure vultures

It's been reported that a foreclosure mill, that was using

fraud to kick out delinquent homeowners and non-deliquent ones,

on behalf of the banks that are wiping out the middle class

in the US, has now been bitten,

by something as innocuous as a Hallowe'en party.

The lawyers and others at Steven J Baum lawyers dressed like

the homeless and lampooned the most unfortunate in society.

The NY Times caught them in the act and reported it. Now,

because of their bruta figura, Freddie Mac (or the other one)

wanted nothing to do with the company (that was breaking the

law anyway- no problem with that) because of the notoriety.

So, since they could no longer break the law in aid of the banks,

they had to close up shop. Note the crying letter that the boss

of Baum sent to the NY Times. I was in tears from the laughter.

and let's not forget, these arse-wipes ARE LUCKY NOT TO BE IN JAIL.

checkitout: Ny Times

Foreclosure Firm Steven J. Baum to Close Down

By PETER LATTMAN

In a photo from a former employee of the law firm of Steven J. Baum, two employees mocked homeowners whose homes had been foreclosed. In a photo from a former employee of the law firm of Steven J. Baum, two employees mocked homeowners whose homes had been foreclosed.

A law firm that had become a lightning rod in the controversy over mortgage-foreclosure practices has shut down, costing 89 employees their jobs.

The Steven J. Baum P.C. law firm, which has offices in Amherst, N.Y., and Westbury, N.Y., has filed papers with government agencies notifying them that it plans to close. It made the filings under a federal law requiring employers to provide notice before mass layoffs.

“Disrupting the livelihoods of so many dedicated and hardworking people is extremely painful, but the loss of so much business left us no choice but to file these notices,” said Mr. Baum in a statement issued on Monday. A firm spokesman said it would have no further comment beyond the release.

Mr. Baum and his colleagues have come under fire for their foreclosure-related legal work. They are one of numerous firms across the country that represent banks and services in trying to foreclose on the millions of homeowners who have defaulted on their loans. Some of these firms’ aggressive, and, in some cases, duplicitous practices, have earned them the moniker “foreclosure mills.”

The Baum firm’s tactics, which included the “robo-signing” of documents, has been among the most criticized. Last year, a state court judge in Brooklyn called one foreclosure filing from the Baum firm “incredible, outrageous, ludicrous and disingenuous.”

Last month, the firm struck a settlement with the United States attorney’s office in Manhattan, which had been investigating the Baum firm and whether, on behalf of its lender clients, it filed misleading legal papers to expedite foreclosures. The firm agreed to pay a $2 million penalty and vowed change its practices to resolve the case.

“In mortgage foreclosure proceedings, there are no excuses for sloppy practices that could lead to someone mistakenly losing their home,” Preet S. Bharara, the United States attorney in Manhattan, said in a statement at the time of the settlement. “Homeowners facing foreclosure cannot afford to have faulty paperwork or inadequate evidence submitted, and today’s agreement will help minimize that risk.”

But despite its settlement with the federal government, the firm’s fortunes worsened this month after The New York Times published photos of a Halloween party at the Baum firm showing employees wearing costumes mocking people who had lost their homes.

After those photos surfaced, the mortgage giants Freddie Mac and Fannie Mae cut off the Baum firm, forbidding servicers of their mortgages from using Mr. Baum and his colleagues. That effectively served as the firm’s death knell.

On Saturday, Joe Nocera, The Times columnist who originally wrote about the firm’s Halloween party, published another column about the controversy. In it, he quoted an e-mail that Mr. Baum had sent him last week.

“Mr. Nocera — You have destroyed everything and everyone related to Steven J. Baum PC,” said the letter. “It took 40 years to build this firm and three weeks to tear down.”

“I think that’s what they call shooting the messenger,” Mr. Nocera wrote.

Monday 21 November 2011

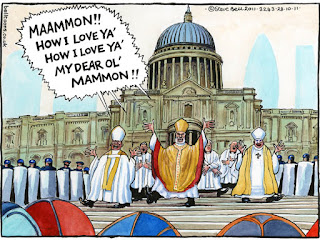

The real people's assembly at St Paul's London

The Occupy movement is spreading to Finsbury and now Hackney.

Thanks to UBS investment in empty buildings, they have shown how

the generosity of greedy bankers leaves lots for the rest of us

benefit from. Their emptiness is the opening of the Bank of Ideas.

This is as close to a vox pop that there is. It is aiming at

the great evils of life

Bankers

City of London Corporation

Deaf, corrupt politicians

Their work bests any official parliamentary assembly:

1 the corp dares to join the debat-

• An extraordinary event took place outside St Paul's on Sunday evening. The Reclaim the City campaign group had arranged for George Monbiot, John Christensen and Fr William Taylor to explain to the Occupation their concerns with the City of London Corporation.

Unexpectedly Stuart Fraser, the policy chairman of the corporation, turned up to debate with us. What was remarkable was how easily Fraser conceded defeat on so many points. In an effort to claim the corporation was a modern, democratic institution – in response to George Monbiot's article (Comment, 1 November) – Fraser said anyone was able to become an alderman. Taylor, a former corporation councillor, pointed out that this was wrong on three counts: you need a liveryman or common councillor/alderman to propose and second you (then you need to pay £30); to be an alderman, you have to be accepted as a justice of the peace; as an alderman you are expected to take your turn as lord mayor, for which you must have around £30,000 of your own money to throw a lord mayor's banquet.

So, if you are poor and/or not well connected, you cannot become an alderman. Fraser conceded all these points. While mainstream politicians are well used to ducking and dodging questions, one got the feeling that councillors in the corporation have not been subject to the regular challenges necessary to hone such skills.

And while Fraser said in his Response column (4 November) that "talk of the City of London being 'an official old boys' network' is wide of the mark", when challenged in a public forum it was clear there are ample grounds for using that label.

Much of the media struggles to see the point of the Occupation. But it felt to many of us freely debating outside St Paul's on Sunday that we were starting to see what real democracy might look like.

Philip Goff

University of Liverpool

2 rebuttal to the Corp

• Stuart Fraser's claim that the City of London Corporation recognises the democratic rights of the 300,000 people who work in the City by giving the vote to their employers is completely absurd (Response, 4 November).

So too is his claim about the "huge diversity" of experience within the corporation's governing council. Most of its members belong to secret societies – the freemasons and the livery companies. Membership of these societies is not open to all, and in the case of the former women are not admitted.

Although the corporation is the smallest local authority in Britain, its public relations department is the largest. Its charitable contributions amount to petty cash when measured against the corporation's vast resources, which have remained concealed to public scrutiny since before the days when witches were burnt at the stake.

Nigel Wilkins

London

Occupy London protesters issue demands to lord mayor

3 the media tries to make people go back to sleep

"oh, yes the Corp will listen to the protesters and we can all go home" NOT!

St Paul's protesters may move soon if demands for more transparency to City of London Corporation are met

* Allegra Stratton, political correspondent

* guardian.co.uk, Tuesday 8 November 2011 20.06 GMT

Occupy London protesters outside St Paul's have put demands to the City of London Corporation which, if accepted, may prompt them to leave the cathedral area. The camp already planned to move further back on Friday to avoid impeding Remembrance Sunday commemorations, but now conceivably might leave entirely at the weekend.

David Cameron defended the right to protest, but questioned the camp's effectiveness: "Obviously, the right of people to protest is fundamental to our country. The idea of establishing tents in the middle of our city, I don't feel is particularly constructive. I don't think it's particularly constructive in Parliament Square, and I don't think it's particularly constructive at St Paul's."

The document from Occupy London's general assembly is the first set of agreed demands, and raises the renewed possibility of negotiation with the corporation, after previous talks broke down. Bryn Phillips, who helped draw up the demands, said he was meeting the lord mayor to hand over the group's demands, which he regarded as a significant advance.

On Monday night protesters voted for demands that, if they were to be accepted, would open the corporation, the local authority for the area housing the UK's financial centre, to more scrutiny. Those present said that 200 people voted for the document asking the corporation to open itself to freedom of information requests, publish its accounts retrospectively to 2008, and reveal its financial involvements. A third proposal is for a commission, with representatives of the main Westminster parties, to look at reforming the corporation, with the archbishop of Canterbury suggested to chair it.

The Occupy statement says democratic reform is "urgently needed" for an "unconstitutional and unfair" institution. It calls for:

• An end to business and corporate votes in elections, which can outvote residents.

• Removal of "secrecy practices", and transparent reform of institutions.

• Decommissioning of the City of London police, with officers put under the Met.

• Abolition of the offices of lord mayor, sheriffs and aldermen.

• A truth and reconciliation commission to examine allegations of corruption.

Phillips said: "We think that the public will look at our request and think it reasonable. The City just forgot the public."

The prime minister is expected on Thursday to respond to accusations from protesters and Labour that the government does little to help the "other 99%". Cameron is keen to wrest from Ed Miliband use of the soundbite "predator capitalism", which polls well in focus groups and chimes with Cameron speeches in opposition on "ethical capitalism".

Thanks to UBS investment in empty buildings, they have shown how

the generosity of greedy bankers leaves lots for the rest of us

benefit from. Their emptiness is the opening of the Bank of Ideas.

This is as close to a vox pop that there is. It is aiming at

the great evils of life

Bankers

City of London Corporation

Deaf, corrupt politicians

Their work bests any official parliamentary assembly:

1 the corp dares to join the debat-

• An extraordinary event took place outside St Paul's on Sunday evening. The Reclaim the City campaign group had arranged for George Monbiot, John Christensen and Fr William Taylor to explain to the Occupation their concerns with the City of London Corporation.

Unexpectedly Stuart Fraser, the policy chairman of the corporation, turned up to debate with us. What was remarkable was how easily Fraser conceded defeat on so many points. In an effort to claim the corporation was a modern, democratic institution – in response to George Monbiot's article (Comment, 1 November) – Fraser said anyone was able to become an alderman. Taylor, a former corporation councillor, pointed out that this was wrong on three counts: you need a liveryman or common councillor/alderman to propose and second you (then you need to pay £30); to be an alderman, you have to be accepted as a justice of the peace; as an alderman you are expected to take your turn as lord mayor, for which you must have around £30,000 of your own money to throw a lord mayor's banquet.

So, if you are poor and/or not well connected, you cannot become an alderman. Fraser conceded all these points. While mainstream politicians are well used to ducking and dodging questions, one got the feeling that councillors in the corporation have not been subject to the regular challenges necessary to hone such skills.

And while Fraser said in his Response column (4 November) that "talk of the City of London being 'an official old boys' network' is wide of the mark", when challenged in a public forum it was clear there are ample grounds for using that label.

Much of the media struggles to see the point of the Occupation. But it felt to many of us freely debating outside St Paul's on Sunday that we were starting to see what real democracy might look like.

Philip Goff

University of Liverpool

2 rebuttal to the Corp

• Stuart Fraser's claim that the City of London Corporation recognises the democratic rights of the 300,000 people who work in the City by giving the vote to their employers is completely absurd (Response, 4 November).

So too is his claim about the "huge diversity" of experience within the corporation's governing council. Most of its members belong to secret societies – the freemasons and the livery companies. Membership of these societies is not open to all, and in the case of the former women are not admitted.

Although the corporation is the smallest local authority in Britain, its public relations department is the largest. Its charitable contributions amount to petty cash when measured against the corporation's vast resources, which have remained concealed to public scrutiny since before the days when witches were burnt at the stake.

Nigel Wilkins

London

Occupy London protesters issue demands to lord mayor

3 the media tries to make people go back to sleep

"oh, yes the Corp will listen to the protesters and we can all go home" NOT!

St Paul's protesters may move soon if demands for more transparency to City of London Corporation are met

* Allegra Stratton, political correspondent

* guardian.co.uk, Tuesday 8 November 2011 20.06 GMT

Occupy London protesters outside St Paul's have put demands to the City of London Corporation which, if accepted, may prompt them to leave the cathedral area. The camp already planned to move further back on Friday to avoid impeding Remembrance Sunday commemorations, but now conceivably might leave entirely at the weekend.

David Cameron defended the right to protest, but questioned the camp's effectiveness: "Obviously, the right of people to protest is fundamental to our country. The idea of establishing tents in the middle of our city, I don't feel is particularly constructive. I don't think it's particularly constructive in Parliament Square, and I don't think it's particularly constructive at St Paul's."

The document from Occupy London's general assembly is the first set of agreed demands, and raises the renewed possibility of negotiation with the corporation, after previous talks broke down. Bryn Phillips, who helped draw up the demands, said he was meeting the lord mayor to hand over the group's demands, which he regarded as a significant advance.

On Monday night protesters voted for demands that, if they were to be accepted, would open the corporation, the local authority for the area housing the UK's financial centre, to more scrutiny. Those present said that 200 people voted for the document asking the corporation to open itself to freedom of information requests, publish its accounts retrospectively to 2008, and reveal its financial involvements. A third proposal is for a commission, with representatives of the main Westminster parties, to look at reforming the corporation, with the archbishop of Canterbury suggested to chair it.

The Occupy statement says democratic reform is "urgently needed" for an "unconstitutional and unfair" institution. It calls for:

• An end to business and corporate votes in elections, which can outvote residents.

• Removal of "secrecy practices", and transparent reform of institutions.

• Decommissioning of the City of London police, with officers put under the Met.

• Abolition of the offices of lord mayor, sheriffs and aldermen.

• A truth and reconciliation commission to examine allegations of corruption.

Phillips said: "We think that the public will look at our request and think it reasonable. The City just forgot the public."

The prime minister is expected on Thursday to respond to accusations from protesters and Labour that the government does little to help the "other 99%". Cameron is keen to wrest from Ed Miliband use of the soundbite "predator capitalism", which polls well in focus groups and chimes with Cameron speeches in opposition on "ethical capitalism".

system D- the future of small-scale capitalism

If we are increasingly being kept out of the 'better tomorrow through technology' because of bankers and their technology, we'll have to go back to a simpler life. Bartering, fixing, trading, growing food. Surviving by our wits.

That's life in the Third World, where entrepreneurship reigns. If you watch any videos with Ha Joon Chang, you'll see that the Third World doesn't need Harvard grads to sort out their markets. In fact, the Harvard grads are the ones who have taken over and corrupted Th.W governments and taken all the money to the Caymans.

Entrepreneurship is commonplace in poor countries. They just need the West to stop screwing with their economies, which will never happen.

some musical entrepreneurship

[96 degrees]

checkitout: from Foreign policyThe Shadow Superpower

Forget China: the $10 trillion global black market is the world's fastest growing economy -- and its future. BY ROBERT NEUWIRTH | OCTOBER 28, 2011

With only a mobile phone and a promise of money from his uncle, David Obi did something the Nigerian government has been trying to do for decades: He figured out how to bring electricity to the masses in Africa's most populous country.

For More

--------------------------------------------------------------------------------

Welcome to Bazaaristan

photos from the trillion shadow economy

It wasn't a matter of technology. David is not an inventor or an engineer, and his insights into his country's electrical problems had nothing to do with fancy photovoltaics or turbines to harness the harmattan or any other alternative sources of energy. Instead, 7,000 miles from home, using a language he could hardly speak, he did what traders have always done: made a deal. He contracted with a Chinese firm near Guangzhou to produce small diesel-powered generators under his uncle's brand name, Aakoo, and shipped them home to Nigeria, where power is often scarce. David's deal, struck four years ago, was not massive -- but it made a solid profit and put him on a strong footing for success as a transnational merchant. Like almost all the transactions between Nigerian traders and Chinese manufacturers, it was also sub rosa: under the radar, outside of the view or control of government, part of the unheralded alternative economic universe of System D.

You probably have never heard of System D. Neither had I until I started visiting street markets and unlicensed bazaars around the globe.

More...

System D is a slang phrase pirated from French-speaking Africa and the Caribbean. The French have a word that they often use to describe particularly effective and motivated people. They call them débrouillards. To say a man is a débrouillard is to tell people how resourceful and ingenious he is. The former French colonies have sculpted this word to their own social and economic reality. They say that inventive, self-starting, entrepreneurial merchants who are doing business on their own, without registering or being regulated by the bureaucracy and, for the most part, without paying taxes, are part of "l'economie de la débrouillardise." Or, sweetened for street use, "Systeme D." This essentially translates as the ingenuity economy, the economy of improvisation and self-reliance, the do-it-yourself, or DIY, economy. A number of well-known chefs have also appropriated the term to describe the skill and sheer joy necessary to improvise a gourmet meal using only the mismatched ingredients that happen to be at hand in a kitchen.

I like the phrase. It has a carefree lilt and some friendly resonances. At the same time, it asserts an important truth: What happens in all the unregistered markets and roadside kiosks of the world is not simply haphazard. It is a product of intelligence, resilience, self-organization, and group solidarity, and it follows a number of well-worn though unwritten rules. It is, in that sense, a system.

Video games. Our economy is an HFT video game

Money doesn't go clink or crumple any more. It goes beep.

Banks can create money, i.e. debt, at the press of a button. There's got to be something wrong with that. Now that debt is out of control, the governments of the world want to make money even more of an abstract notion.

It'll be extra abstract for us. As in, they got it, and we don't.

I thought "that's the meaning of the following video" as well. Either that or it hints at a better time when women who dared go in public were looking for a good time.

Here's a lady who was made by committe to please old-fashioned guys who think with their boners when they buy music. A sure success. New name, too: Lana Del Rey. Hints of Brazil, without the booty-shaking. She's designed to fill the gap after the loss of Amy Whinehouse, who was an artist.

[Watch the lips. Talking about video games.]

checkitout:

Money has been privatised by stealthThe greatest privatisation in history has gone unnoticed. It's time to take from the banks the power to produce money

o Ben Dyson

o guardian.co.uk, Tuesday 15 November 2011 10.47 GMT

It's common knowledge that printing your own £10 notes at home is frowned upon by Her Majesty's police. Yet there's a small collection of companies that are authorised to create – and spend – more new money than the counterfeiters have ever been able to print. In industry jargon, these companies are called "monetary and financial institutions", but you probably know them by their street name: "banks".

The money that they create, effectively out of nothing, isn't the paper money that bears the logo of the government-owned Bank of England. It's the electronic money that flashes up on the screen when you check your balance at an ATM. Right now, this electronic money makes up over 97% of all the money in the economy. Only 3% of money is still in that old-fashioned form of real cash that can be touched.

Hard to believe, isn't it? Martin Wolf, one of the experts who sat on the independent commission on banking, put it bluntly, saying in the Financial Times that "the essence of the contemporary monetary system was the creation of money, out of nothing, by private banks' often foolish lending".

Here's how it works. When you ask the bank for the money to buy a one-bedroom box in London, the money that appears in your account isn't borrowed from some prudent grandmother's life savings. In fact, the bank simply types those numbers into your account, creating brand new money that you can now spend. As other banks do exactly the same, the amount of money in the economy grows and grows. Every new mortgage creates new money, which pushes up house prices just a little more and forces the next buyer to borrow even more from the banks. (A more detailed and fully-referenced explanation of this process is given in the book Where Does Money Come From? published by the New Economics Foundation.)

....Of course, the flipside to this creation of money is that with every new loan comes a new debt. This is the source of our mountain of personal debt – not money that had been prudently saved up by pensioners, but money that was created out of nothing by banks and lent to anyone and everyone. Eventually the debt burden becomes just too high, and we see the wave of defaults that triggered the start of the ongoing financial crisis.

....This brings us to a very simple solution to the financial crisis. Many of the current protesters might be surprised to hear that the answer to our current crisis comes from a former Tory prime minister. Back in 1844, Sir Robert Peel realised that metal coins, which at that time were the only legal form of money, had been superseded by new paper notes issued by banks. These paper notes were lighter and more convenient, and therefore much more popular. Peel's 1844 Bank Charter Act took the power to create paper money away from the banks and placed it back under control of the Bank of England. We should now do exactly the same with the power to create electronic money. My own organisation, Positive Money, has even drafted the legislation that would be required to do this.

Banks can create money, i.e. debt, at the press of a button. There's got to be something wrong with that. Now that debt is out of control, the governments of the world want to make money even more of an abstract notion.

It'll be extra abstract for us. As in, they got it, and we don't.

I thought "that's the meaning of the following video" as well. Either that or it hints at a better time when women who dared go in public were looking for a good time.

Here's a lady who was made by committe to please old-fashioned guys who think with their boners when they buy music. A sure success. New name, too: Lana Del Rey. Hints of Brazil, without the booty-shaking. She's designed to fill the gap after the loss of Amy Whinehouse, who was an artist.

[Watch the lips. Talking about video games.]

checkitout:

Money has been privatised by stealthThe greatest privatisation in history has gone unnoticed. It's time to take from the banks the power to produce money

o Ben Dyson

o guardian.co.uk, Tuesday 15 November 2011 10.47 GMT

It's common knowledge that printing your own £10 notes at home is frowned upon by Her Majesty's police. Yet there's a small collection of companies that are authorised to create – and spend – more new money than the counterfeiters have ever been able to print. In industry jargon, these companies are called "monetary and financial institutions", but you probably know them by their street name: "banks".

The money that they create, effectively out of nothing, isn't the paper money that bears the logo of the government-owned Bank of England. It's the electronic money that flashes up on the screen when you check your balance at an ATM. Right now, this electronic money makes up over 97% of all the money in the economy. Only 3% of money is still in that old-fashioned form of real cash that can be touched.

Hard to believe, isn't it? Martin Wolf, one of the experts who sat on the independent commission on banking, put it bluntly, saying in the Financial Times that "the essence of the contemporary monetary system was the creation of money, out of nothing, by private banks' often foolish lending".

Here's how it works. When you ask the bank for the money to buy a one-bedroom box in London, the money that appears in your account isn't borrowed from some prudent grandmother's life savings. In fact, the bank simply types those numbers into your account, creating brand new money that you can now spend. As other banks do exactly the same, the amount of money in the economy grows and grows. Every new mortgage creates new money, which pushes up house prices just a little more and forces the next buyer to borrow even more from the banks. (A more detailed and fully-referenced explanation of this process is given in the book Where Does Money Come From? published by the New Economics Foundation.)

....Of course, the flipside to this creation of money is that with every new loan comes a new debt. This is the source of our mountain of personal debt – not money that had been prudently saved up by pensioners, but money that was created out of nothing by banks and lent to anyone and everyone. Eventually the debt burden becomes just too high, and we see the wave of defaults that triggered the start of the ongoing financial crisis.

....This brings us to a very simple solution to the financial crisis. Many of the current protesters might be surprised to hear that the answer to our current crisis comes from a former Tory prime minister. Back in 1844, Sir Robert Peel realised that metal coins, which at that time were the only legal form of money, had been superseded by new paper notes issued by banks. These paper notes were lighter and more convenient, and therefore much more popular. Peel's 1844 Bank Charter Act took the power to create paper money away from the banks and placed it back under control of the Bank of England. We should now do exactly the same with the power to create electronic money. My own organisation, Positive Money, has even drafted the legislation that would be required to do this.

Bass is doing the fishing. Kyle, that is

[a'mo get me a piece of that bass]

[a'mo get me a piece of that bass]As he's a hedger, I'd like to stop his kind of shenanigans, but since nobody in power will, let's learn from his wisdom. He saw the Euro imbalances long before the crashes and hedged against them.

Bingo. Ching-ching

Bass also foresaw that countries would bail out their banks. I'm glad he's scoring money on that most stupid of adventures that governments have embarked on.

Play-by-play

8:40 Greek=German debt

10:35 debt rightdowns. German pope, Italian banker

1200 europe is overlevered

1300 mexican standoff

Some other wise ideas below

checkitout: from a Zerohedge story, quoting Bass

"From now on, it seems everything will be deemed to be a liquidity crisis that will be met with more "bailouts" and debt financed spending. This will eventually break traction in a violent way and facilitate severe inflation or even hyperinflation. The one thing the EU taught us this weekend is that paper money will be worth less (maybe much less) in the future." And indeed it will, because more than anything, money is increasingly and rightfully seen as the symbol of the free lunch that Keynesian economics promises, after that "just one final debt hit." Is there much or any hope? Not really, but being prepared while watching the inferno blazes soar higher and higher is the best we can all do.

The all-encompassing summary paragraph:

This weekend, the EU and the IMF effectively went all in with a bad hand in the highest stakes game of financial poker ever played with the world. We believe the agreement released was nothing more than a Potemkin agreement in order to placate bond investors. In the end (and there will be a reckoning for many countries) nations, including the United States, need to dramatically cut spending and get their fiscal balances in order. Unfortunately, our elected officials are on the hamster wheel of electoral cycles and are not able to make tough decisions like this as they would likely not be re?elected without a “sea change” in public opinion towards government spending and deficits.

Monday 14 November 2011

get your house in order, and every house needs a gun

when the Eurocrats tell Greece to cut its expenses,

that does not mean guns, because France and Germany

have been pressuring Greece (and the US has too)

to keep buying arms, just like I've been saying.

So, I hope those guns get put to good use when

the Eurocrats send in their armies, or the Turks.

checkitout: Independent

Less healthcare, but Greece is still buying guns

Greeks furious at 'intact' arms spending as eurozone

leaders insist on cuts to their public services Roxane McMeeken Athens

Sunday 06 November 2011

As Greece is forced by European leaders to abandon a referendum to allow the people the chance to vote on its latest bailout conditions, the country is preparing for yet another dose of austerity.

The conditions of the next €130bn rescue package will be severe, yet there is an elephant in the room: the extent to which the German but also the French military industries rely on Greece.

The small, crisis-hit nation, whose prime minister, George Papandreou, narrowly survived a vote of confidence on Friday, buys more German weapons than any other country. Some Greeks want to know why it is that France and Germany are demanding cuts in pensions, salaries and public services, but the buying of arms is allowed to continue unabated.

Yanis Varoufakis, professor of economics at Athens University, says: "When Greek hospitals are running out of bandages, the only bit of the budget not being attacked by the EU and IMF is military expenditure."

Greece is the highest military spender, in terms of percentage of GDP, in the EU. Professor Varoufakis adds: "Greece is a disproportionately crucial customer for the arma-ments industry. In comparison to Greece's size, it's preposterous."

Despite its dire financial straits, the country's military expenditure has risen during the global financial crisis. It spent €7.1bn in 2010, compared with €6.24bn in 2007.

Some 58 per cent of Greece's military expenditure in 2010 went to Germany, according to the Stockholm International Peace Research Institute (Sipri).

The US is the major beneficiary of Greek military expenditure, with the Americans supplying 42 per cent of its arms. In second and third place are Germany, with 22.7 per cent, and then France, with 12.5 per cent.

Professor Varoufakis believes: "The EU and IMF keep giving loans to Greece to stop it going bankrupt, but countries such as Germany need to justify this to voters, hence the demand for spending cuts. But with Greece being such a crucial arms customer, it only takes a phone call to the German government from an armaments manufacturer to ensure that Greece's military budget stays intact."

Greece's defence budget is historically high due to the perceived threat from neighbouring Turkey. Arms companies have benefited by playing the two sides off against each other. Professor Varoufakis says: "Typically, one side buys, say, a frigate, and then the other buys the same frigate – with the only difference being the colour of the paint."

However, critics in Greece argue that, as an EU member, Greece should be guaranteed protection from Turkey by its more powerful allies. Although the EU is not a military alliance, common sense suggests that Greece could reasonably expect support if it was attacked by Turkey.

.....

that does not mean guns, because France and Germany

have been pressuring Greece (and the US has too)

to keep buying arms, just like I've been saying.

So, I hope those guns get put to good use when

the Eurocrats send in their armies, or the Turks.

checkitout: Independent

Less healthcare, but Greece is still buying guns

Greeks furious at 'intact' arms spending as eurozone

leaders insist on cuts to their public services Roxane McMeeken Athens

Sunday 06 November 2011

As Greece is forced by European leaders to abandon a referendum to allow the people the chance to vote on its latest bailout conditions, the country is preparing for yet another dose of austerity.

The conditions of the next €130bn rescue package will be severe, yet there is an elephant in the room: the extent to which the German but also the French military industries rely on Greece.

The small, crisis-hit nation, whose prime minister, George Papandreou, narrowly survived a vote of confidence on Friday, buys more German weapons than any other country. Some Greeks want to know why it is that France and Germany are demanding cuts in pensions, salaries and public services, but the buying of arms is allowed to continue unabated.

Yanis Varoufakis, professor of economics at Athens University, says: "When Greek hospitals are running out of bandages, the only bit of the budget not being attacked by the EU and IMF is military expenditure."

Greece is the highest military spender, in terms of percentage of GDP, in the EU. Professor Varoufakis adds: "Greece is a disproportionately crucial customer for the arma-ments industry. In comparison to Greece's size, it's preposterous."

Despite its dire financial straits, the country's military expenditure has risen during the global financial crisis. It spent €7.1bn in 2010, compared with €6.24bn in 2007.

Some 58 per cent of Greece's military expenditure in 2010 went to Germany, according to the Stockholm International Peace Research Institute (Sipri).

The US is the major beneficiary of Greek military expenditure, with the Americans supplying 42 per cent of its arms. In second and third place are Germany, with 22.7 per cent, and then France, with 12.5 per cent.

Professor Varoufakis believes: "The EU and IMF keep giving loans to Greece to stop it going bankrupt, but countries such as Germany need to justify this to voters, hence the demand for spending cuts. But with Greece being such a crucial arms customer, it only takes a phone call to the German government from an armaments manufacturer to ensure that Greece's military budget stays intact."

Greece's defence budget is historically high due to the perceived threat from neighbouring Turkey. Arms companies have benefited by playing the two sides off against each other. Professor Varoufakis says: "Typically, one side buys, say, a frigate, and then the other buys the same frigate – with the only difference being the colour of the paint."

However, critics in Greece argue that, as an EU member, Greece should be guaranteed protection from Turkey by its more powerful allies. Although the EU is not a military alliance, common sense suggests that Greece could reasonably expect support if it was attacked by Turkey.

.....

the most cunning terrorists are running Europe NOW!

When you put it into one paragraph it's truly shocking.

Most terrorists like to blow stuff up and get caught, or

martyred, and end of story.

The cunning ones try to destroy the polity from inside the

system.

That's what we got in the EU, right now.

Checkitout: taki's mag [follow the link for more. it's gooood]

Nothing Left to Steal

by Taki Theodoracopulos November 10, 2011

Another thing you Brits forgot: Delors, Trichet, and the generation of 1968 are now in the positions of power. The ludicrous Baroness Ashton—still cramming to understand what the word bonjour means—was a CND/CPGB fellow traveler; Javier Solana an ex-Trotskyite; Manuel Barroso an ex-Maoist; Joschka Fisher an ex-terrorist; and so on. In other words, the scum that failed to win power over us through force of arms is now leading us by the nose through stealth and the EU Trojan horse. Somebody wake up David Cameron.....

[Please share this article by using the link below. When you cut and paste an article, Taki's Magazine misses out on traffic, and our writers don't get paid for their work. Email editors@takimag.com to buy additional rights. http://takimag.com/article/nothing_left_to_steal/print#ixzz1dVAxJAlw

Most terrorists like to blow stuff up and get caught, or

martyred, and end of story.

The cunning ones try to destroy the polity from inside the

system.

That's what we got in the EU, right now.

Checkitout: taki's mag [follow the link for more. it's gooood]

Nothing Left to Steal

by Taki Theodoracopulos November 10, 2011

Another thing you Brits forgot: Delors, Trichet, and the generation of 1968 are now in the positions of power. The ludicrous Baroness Ashton—still cramming to understand what the word bonjour means—was a CND/CPGB fellow traveler; Javier Solana an ex-Trotskyite; Manuel Barroso an ex-Maoist; Joschka Fisher an ex-terrorist; and so on. In other words, the scum that failed to win power over us through force of arms is now leading us by the nose through stealth and the EU Trojan horse. Somebody wake up David Cameron.....

[Please share this article by using the link below. When you cut and paste an article, Taki's Magazine misses out on traffic, and our writers don't get paid for their work. Email editors@takimag.com to buy additional rights. http://takimag.com/article/nothing_left_to_steal/print#ixzz1dVAxJAlw

the opposite of the Big Bang is Big Implosion

the freeing of the stock markets under Maggie THatcher

was known as the Big Bang. Nice metaphor.

Except it should have killed most of the bankers with its

force in much the same way that it is hurting society now.

Indeed it's causing a Big Implosion in the rest of society.

checkitout: Guardian

Who can deliver the cultural Big Bang that the City needs?

Thatcher's unleashing of the markets led to crisis 25 years later. Now only politicians, if they have the guts, can force reform

David Kynaston guardian.co.uk, Monday 24 October 2011 22.00 BST

Big Bang created the City we know today, but this week's 25th anniversary is not an occasion for triumphalism. Severe faultlines in our financial system continue to bear heavy responsibility for the debilitating economic conditions that have persisted since the banking dramas of 2007-8. Reform is needed as urgently now as it was then, but over recent years dismayingly little has been achieved. Even so, City history tells us not only that change-minded politicians have on occasion been able to bend the City to their will, but that the City has always been capable, for all its protests, of adapting to new external pressures.

Big Bang itself took place on 27 October 1986 and was essentially the deregulation of the stock exchange, opening up its member firms to foreign ownership, mainly American banks. It conclusively signalled the third phase of the City of London's modern history and sought to reprise the marvels of the first phase which ended with the onset of the first world war. Before that, for almost a century, the City was in its freebooting pomp, dispensing capital and credit to all quarters of the globe and becoming the greatest international financial centre the world had seen.

The second phase, from the end of the 1914-18 war to the mid-80s, began with New York supplanting London, compelling the City to engage closely for the first time with British industry. But the rise of the European markets in the 60s, followed by the floating of exchange rates and abolition of exchange controls, meant that by the early 80s the forces for a re-internationalisation of the City had become irresistible. Yet they were still mostly resisted by the City itself, a complacent place where restrictive practices ruled and the living was largely easy. Thus the Margaret Thatcher-imposed Big Bang.

Phase three would prove, in its own terms, a brilliantly conceived and realised vision. Frankfurt and Paris may have both aspired to be Europe's dominant financial capital, but from the 1990s they were left trailing far behind. Indeed, London by the new century was leading the world, well ahead of New York and Tokyo. Unfortunately it was an international financial capital with deeply problematic characteristics.

Not least as a result of the presence of turbo-charged US investment banks. In some ways it was a positive process, as a fiercely driven meritocracy replaced nepotistic capitalism. But damaging downsides included the creation of behemoths liable to conflicts of interest; transactional banking supplanting relationship banking; an aggressively competitive bonus culture; and risky proprietary trading, with "swinging dick" traders driven by the lure of a bonus to take huge one-way bets – one way because they were gambling with "other people's money", impossible in the City's old partnership structure.

Big Bang altered the City in another fundamental way. The hitherto cohesive, club-like, face-to-face dealings between people of similar background changed from the 80s: the composition became less white, British and male, the financial world spread beyond the Square Mile, and the old intimacy gave way to screens and large, self-contained silos. Traditionally the City had run on trust – crucial for financial stability – but in autumn 2008, the absence of that vital ingredient was painfully apparent as interbank money markets dried up.

It also involved a conscious new model for the British economy. With de-industrialisation already under way, the Thatcher government bet the house on services, above all financial services. Crucially, these would be geared to the world at large rather than the domestic economy, least of all manufacturing. Over the next 20 years, as the City roared on, few questioned that model or the implications of the City becoming an increasingly detached, offshore island, with the grotesque imbalance in material rewards sucking in the brightest and best. And of course, City taxes paid for many new schools and hospitals.

....

was known as the Big Bang. Nice metaphor.

Except it should have killed most of the bankers with its

force in much the same way that it is hurting society now.

Indeed it's causing a Big Implosion in the rest of society.

checkitout: Guardian

Who can deliver the cultural Big Bang that the City needs?

Thatcher's unleashing of the markets led to crisis 25 years later. Now only politicians, if they have the guts, can force reform

David Kynaston guardian.co.uk, Monday 24 October 2011 22.00 BST

Big Bang created the City we know today, but this week's 25th anniversary is not an occasion for triumphalism. Severe faultlines in our financial system continue to bear heavy responsibility for the debilitating economic conditions that have persisted since the banking dramas of 2007-8. Reform is needed as urgently now as it was then, but over recent years dismayingly little has been achieved. Even so, City history tells us not only that change-minded politicians have on occasion been able to bend the City to their will, but that the City has always been capable, for all its protests, of adapting to new external pressures.

Big Bang itself took place on 27 October 1986 and was essentially the deregulation of the stock exchange, opening up its member firms to foreign ownership, mainly American banks. It conclusively signalled the third phase of the City of London's modern history and sought to reprise the marvels of the first phase which ended with the onset of the first world war. Before that, for almost a century, the City was in its freebooting pomp, dispensing capital and credit to all quarters of the globe and becoming the greatest international financial centre the world had seen.

The second phase, from the end of the 1914-18 war to the mid-80s, began with New York supplanting London, compelling the City to engage closely for the first time with British industry. But the rise of the European markets in the 60s, followed by the floating of exchange rates and abolition of exchange controls, meant that by the early 80s the forces for a re-internationalisation of the City had become irresistible. Yet they were still mostly resisted by the City itself, a complacent place where restrictive practices ruled and the living was largely easy. Thus the Margaret Thatcher-imposed Big Bang.

Phase three would prove, in its own terms, a brilliantly conceived and realised vision. Frankfurt and Paris may have both aspired to be Europe's dominant financial capital, but from the 1990s they were left trailing far behind. Indeed, London by the new century was leading the world, well ahead of New York and Tokyo. Unfortunately it was an international financial capital with deeply problematic characteristics.

Not least as a result of the presence of turbo-charged US investment banks. In some ways it was a positive process, as a fiercely driven meritocracy replaced nepotistic capitalism. But damaging downsides included the creation of behemoths liable to conflicts of interest; transactional banking supplanting relationship banking; an aggressively competitive bonus culture; and risky proprietary trading, with "swinging dick" traders driven by the lure of a bonus to take huge one-way bets – one way because they were gambling with "other people's money", impossible in the City's old partnership structure.

Big Bang altered the City in another fundamental way. The hitherto cohesive, club-like, face-to-face dealings between people of similar background changed from the 80s: the composition became less white, British and male, the financial world spread beyond the Square Mile, and the old intimacy gave way to screens and large, self-contained silos. Traditionally the City had run on trust – crucial for financial stability – but in autumn 2008, the absence of that vital ingredient was painfully apparent as interbank money markets dried up.

It also involved a conscious new model for the British economy. With de-industrialisation already under way, the Thatcher government bet the house on services, above all financial services. Crucially, these would be geared to the world at large rather than the domestic economy, least of all manufacturing. Over the next 20 years, as the City roared on, few questioned that model or the implications of the City becoming an increasingly detached, offshore island, with the grotesque imbalance in material rewards sucking in the brightest and best. And of course, City taxes paid for many new schools and hospitals.

....

Sunday 13 November 2011

the Ouzo-Hall Putsch

CARETAKER governments are signs of war and occupation.

Steve Keen, on the BBC's Hard Talk said the Hitler would not have succeeded were it not for financial crisis in Germany. Nowadays, the financial crisis is being brought to us by the people in the position of Hitler, abrogating democracy, and leading

from Brussels.

Greece and Italy are being occupied by the EU, or the bankers that run the EU.

Take your pick. To make matters worse, there are actual fascists running

ministries in Greece. The fascistic part was not needed to form a national

government, but the plan was to include them and give them ministries, even

though they are a miniscule party. Whose idea was this?

Notice how, below, the austerity has no effect on Greece's purchases of French and German armaments. You can't eat guns and they can't treat patients, or teach kids.

Nigel Farage, a UK MEP, kicks them all in the teeth:

Nigel Farage tells the oligarchs that they are taking democracy away:

checkitout:

1 Mark Ames Exiled Online, on Greece's new junta

Class War For Idiots / November 16, 2011

Austerity & Fascism In Greece: The Real 1% Doctrine By Mark Ames

This article is cross-posted on Naked Capitalism