-Costick67 (8^P

[the marina]

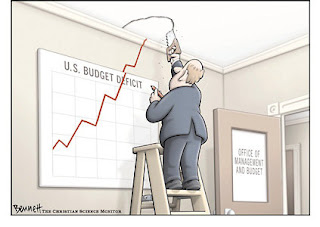

Funny money could not get more surreal

As a young, impressionable lad, I used to be anti-nukes and anti-war. Now, I simply admit that countries will never give up their nuclear defenses. Okay then, how does the UK defend itself?

As a young, impressionable lad, I used to be anti-nukes and anti-war. Now, I simply admit that countries will never give up their nuclear defenses. Okay then, how does the UK defend itself? [thanks to Greenpeace for the snap]

[thanks to Greenpeace for the snap]

One day in the near future:

One day in the near future: [Hiroshima memorial]

[Hiroshima memorial] Used to be that a guy would go off to fight the world for a paycheck. He used to lose faith in humanity and then go home, shell-shocked from the stress, and ignore his wife and kids. Read the paper in his underpants, on the back porch. Normality reigned.

Used to be that a guy would go off to fight the world for a paycheck. He used to lose faith in humanity and then go home, shell-shocked from the stress, and ignore his wife and kids. Read the paper in his underpants, on the back porch. Normality reigned. [pic- daily mail]

[pic- daily mail] Some do the 'guy' act so well that they appear to be colder than the fellas. I've always wondered what kind of pussy-whipped guy would ever want one of those women.

Some do the 'guy' act so well that they appear to be colder than the fellas. I've always wondered what kind of pussy-whipped guy would ever want one of those women. It's as if they aren't women at all. They're just one of the guys.

It's as if they aren't women at all. They're just one of the guys.Birds of a different feather:

It seems that there's another brand of modern woman who at work, or in private life, tries to walk around like feminism never happened. They may not be understanding, but they certainly are feminine. Almost too feminine, like 'Dolls'. Not feminine and normally dressed, but feminine and sexually alluring- all day long. No problem there. It just seems that this too is a reaction to modern life. It's as if the only place for femininity is in the seeking of sexual attention*. Again, no problem for me. They get that attention.

A strange mix, which I've seen before, is the man-with-tits who may be physically appealling, and actually sexually threatening. The kind of gal who will stand eye-to-eye with you and expect to be hit on, or else she'll check your packet. Exciting!

It gets annoying though when they're in a pack of lad-ettes (another modern female archetype), and they've all got fat arses from sitting at a desk all day, and drinking too much beer every night.

[the second group is from Australia, where they're affectionately known as bushpigs]

[the second group is from Australia, where they're affectionately known as bushpigs]

They don't like being rejected, especially when they're three-sheets-to-the-wind. Then it's boot-to-the-nuts time for any shy guy within range. I'm afraid that when the dust clears, it'll be (weak) guys vs (tough) girls, which will be a disaster. Maybe that's why many older, shy guys are finding foreign wives. Most other countries around the world, advanced and not, don't have (wo)men-with-tits. Women act like women, and all some of them want is a good husband (I wonder what the divorce rate is). Of course, their female kids will likely become men-with-tits, so this is just a statistical blip.

I'm afraid that when the dust clears, it'll be (weak) guys vs (tough) girls, which will be a disaster. Maybe that's why many older, shy guys are finding foreign wives. Most other countries around the world, advanced and not, don't have (wo)men-with-tits. Women act like women, and all some of them want is a good husband (I wonder what the divorce rate is). Of course, their female kids will likely become men-with-tits, so this is just a statistical blip.

It's one thing to work overseas and find a wife, or find an immigrant in your country. Buttt, mail-order wives are a disgrace in this century. There was a good British film with that as the central plot.

[this movie temporarily cancels my 'ignore Nicole Kidman' policy**]

-Costick67 (8^P

notes-

* perhaps they're worried that feminists have beaten the crap out of men and that guys need a sexual pick-me-up/ wake-up-call, lest they all go gay. Or maybe they're just desperately looking for a vanishing resource; a civilised yet virile guy (or one with a bottle of viagra), who isn't a wife-beater.

** also Tom Cruise, and Nicolas Cage Copolla

***why do we call young women 'girls'? The age of the infantilisation of adults and sexualisation of children (by advertisers).

Why are lots of normal men hooked on something which

Why are lots of normal men hooked on something which This is a notification for the hedge traders. You know, those guys who've been

This is a notification for the hedge traders. You know, those guys who've been [pic- Walmart board]

[pic- Walmart board] "Hey, you want a Cuban cigar?"

"Hey, you want a Cuban cigar?" [this is the big one. We do ourselves in, and the chimps take over.

[this is the big one. We do ourselves in, and the chimps take over. It's about oil, government and money.

It's about oil, government and money.

by Greg Palast for Truthout.org

May 5, 2010

I've seen this movie before. In 1989, I was a fraud investigator hired to dig into the cause of the Exxon Valdez disaster. Despite Exxon's name on that boat, I found the party most to blame for the destruction was ... British Petroleum. That's important to know, because the way BP caused devastation in

Deepwater Horizon in flames before sinking. Photo provided by D.BecnelTankers run aground, wells blow out, pipes burst. It shouldn't happen but it does. And when it does, the name of the game is containment. Both in

What's so insane, when I look over that sickening slick moving toward the Delta, is that containing spilled oil is really quite simple and easy. And from my investigation, BP has figured out a very low cost way to prepare for this task: BP lies. BP prevaricates, BP fabricates and BP obfuscates.

That's because responding to a spill may be easy and simple, but not at all cheap. And BP is cheap. Deadly cheap.

To contain a spill, the main thing you need is a lot of rubber, long skirts of it called "boom." Quickly surround a spill or leak or burst, then pump it out into skimmers or disperse it, sink it or burn it. Simple.

But there's one thing about the rubber skirts: you've got to have lots of it at the ready, with crews on standby in helicopters and on containment barges ready to roll. They have to be in place round the clock, all the time, just like a fire department; even when all is operating A-OK. Because rapid response is the key. In

Chugach Natives of Alaska clean Exxon Valdez oil off their beach, five years after the spill. 1994©James McAlpine for Palast FundBefore the Exxon Valdez grounding, BP's Alyeska group claimed it had these full-time oil spill response crews. Alyeska had hired Alaskan Natives, trained them to drop from helicopters into the freezing water and set boom in case of emergency. Alyeska also certified in writing that a containment barge with equipment was within five hours sailing of any point in the

[oh, the f$^*£kin humanity of the thing. 11 people died]

[oh, the f$^*£kin humanity of the thing. 11 people died]

Obama44 tried to hoodwink the American public, by using big mathematical concepts like graphs, about how things are going SOOOoo well in Afghanistan. Let's put this in the form of a school Math problem.

Obama44 tried to hoodwink the American public, by using big mathematical concepts like graphs, about how things are going SOOOoo well in Afghanistan. Let's put this in the form of a school Math problem. B)

B) C)

C)

Much like fat-boy here, some people are controlling the yo-yo action.

Much like fat-boy here, some people are controlling the yo-yo action. CHICKEN (Little)

CHICKEN (Little) or screaming 'the sky is falling'

or screaming 'the sky is falling' and have a billion on the side.

and have a billion on the side. OSTRICH

OSTRICH CHAMELEON

CHAMELEON HYENA & WILDEBEEST

HYENA & WILDEBEEST Human life is now too derivative, so to speak.

Human life is now too derivative, so to speak.The Woman Who Just Might Save the Planet and Our Pocketbooks

What if our economy was not built on competition? Nobel Prize winner Elinor Ostrom talks about her work on cooperation in economics.

March 14, 2010 |

For one thing, she is the first woman to receive the prize. Her Ph.D. is in political science, not economics (though she minored in economics, collaborates with many economists, and considers herself a political economist). But what makes this award particularly special is that her work is about cooperation, while standard economics focuses on competition.

Fran Korten, YES! Magazine’s publisher, spent 20 years with the Ford Foundation making grants to support community management of water and forests in Southeast Asia and the United States. She and Ostrom drew on one another’s work as this field of knowledge developed. Fran interviewed her friend and colleague Lin Ostrom shortly after Ostrom received the Nobel Prize.

Fran Korten: When you first learned that you had won the Nobel Prize in Economics, were you surprised?

Elinor Ostrom: Yes. It was quite surprising. I was both happy and relieved.

Fran: Why relieved?

Elinor: Well, relieved in that I was doing a bunch of research through the years that many people thought was very radical and people didn’t like. As a person who does interdisciplinary work, I didn’t fit anywhere. I was relieved that, after all these years of struggle, someone really thought it did add up. That’s very nice.

And it’s very nice for the team that I’ve been a part of here at the Workshop. We have had a different style of organizing. It is an interdisciplinary center—we have graduate students, visiting scholars, and faculty working together. I never would have won the Nobel but for being a part of that enterprise.

Fran: It’s interesting that your research is about people learning to cooperate. And your Workshop at the university is also organized on principles of cooperation.

Elinor: I have a new book coming out in May entitled Working Together, written with Amy Poteete and Marco Janssen. It is on collective actions in the commons. What we’re talking about is how people work together. We’ve used an immense array of different methods to look at this question—case studies, including my own dissertation and Amy’s work, modeling, experiments, large-scale statistical work. We show how people use multiple methods to work together.

Fran: Many people associate “the commons” with Garrett Hardin’s famous essay, “The Tragedy of the Commons.” He says that if, for example, you have a pasture that everyone in a village has access to, then each person will put as many cows on that land as he can to maximize his own benefit, and pretty soon the pasture will be overgrazed and become worthless. What’s the difference between your perspective and Hardin’s?

for more, check Alternet